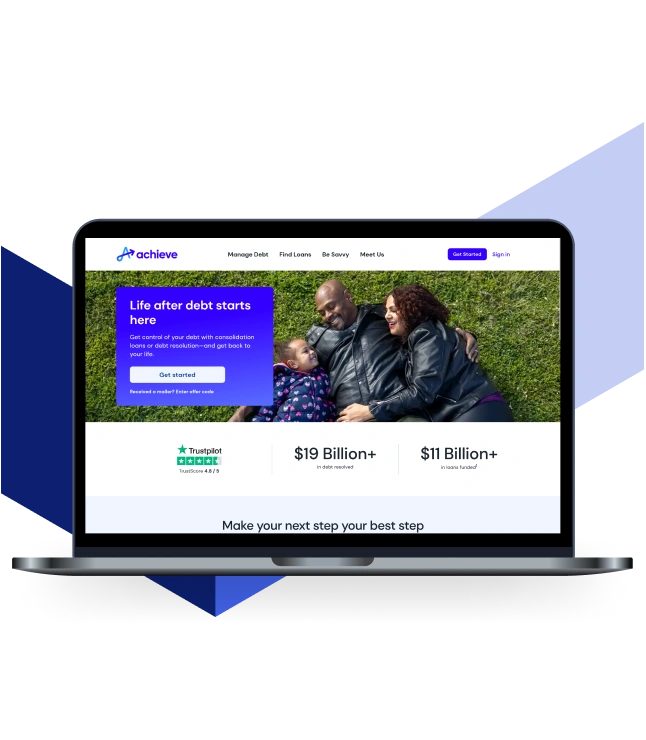

If you have fair or good credit, you could qualify for Achieve personal loans and get reasonable rates and convenient repayment terms. The company’s loans may be used for debt consolidation as it offers direct deposits to creditors with an up to 4.5% APR reduction. You might also get an up to 5.5% discount on your interest rate for adding a co-borrower. Just note that you will be charged some fees for processing your loan request.

Achieve Personal Loan Features

Pros

- Discounts on interest rates;

- Debt consolidation loans with direct monthly payments to creditors;

- Soft credit check on prequalification stage;

- Opportunity to get joint loans.

Cons

- Origination fee from 1.99% to 8.99%;

- High minimum loan amount;

- No mobile app for Android or iOS.

Short Review of Achieve Personal Loans

Achieve, once called FreedomPlus, provides personal loans that can be used for multiple needs, including debt consolidation with a direct deposit to creditors and an APR discount. This lender only accepts borrowers with fair and good credit ratings (620 and higher).

Achieve lets you request to be contacted by its consultant after pre-approval, making it easier to determine whether the option is right for you. With loans starting at $5,000, Achieve may not be best for small expenses and short-term emergencies. Additionally, the service performs a hard credit check if you decide to continue your application and charges an origination fee from 1.99% to 8.99%.

Example of a Personal Loan from Achieve

Suppose that you’re going to borrow $10,000 for 36 months with an APR of 18.49%, which includes a yearly interest rate of 15.99% and a 5% origination fee. Your monthly loan payment will be $351.52. You will receive $9,500 on hand and will repay $12,654.75 in total over the loan life.

The Main Advantages of Achieve Personal Loans

Achieve loans come with several key advantages for a smooth borrowing experience:

- Joint loan offer: When adding a co-borrower in your application, you can get up to a 5.5% reduction on your rate. A co-borrower needs to meet Achieve’s basic requirements.

- Savings for retirement offer: Borrowers showing sufficient retirement savings may cut their interest rate by up to 4 percentage points. Proof of savings in a 401(k), an individual retirement account (IRA), a Roth IRA, or a thrift savings plan is required. Your retirement savings won’t be used as collateral for a loan.

- Direct pay offer: If you’re using an Achieve loan to consolidate debt, you can shrink your rate by up to 4.5 percentage points. It applies when the loan money goes directly to your creditors. For full discount eligibility, at least 85% of the Achieve funds should go to another lender.

- Swift approval and fast funds transfer: A loan decision is usually made the same day for most of Achieve’s clients. Approved borrowers can have their funds delivered within one to three days.

- Soft credit pull for pre-qualification: Achieveonly runs a soft credit pull for pre-qualifying borrowers. This way, you can review potential loan terms and rates before deciding. Your credit score remains unaffected until you proceed with your application.

How to Qualify for an Achieve personal loan?

If you want to apply for an Achieve personal loan, there are several requirements you need to meet. Below are Achieve’s minimum eligibility criteria:

How to Apply for an Achieve Personal Loan?

Achieve has a simple application process, allowing borrowers to request loan funds quickly. Here are the steps that you should follow to apply for a loan from Achieve:

- Go to Achieve’s website to pre-qualify. You’ll need to input your desired loan amount, personal and income details, state of residence, and contact information to start the process.

- View your loan offers and pick one that works for you. After submitting the online form, you’ll get a pre-approval decision and can check your potential rates and terms. Achieve also allows you to contact its loan consultant via phone to decide whether the loan suits you. If you proceed with your application, you need to customize your repayment period and provide documents to prove your income and address. A formal application involves a hard credit check that could temporarily drop your credit score.

- Receive the funds. Borrowers typically get a same-day loan decision. If approved, e-sign the loan agreement and choose how you want to get your funds. Funding may take from 1 to 3 business days.

- Make your payments. Achieve will report your account activity to three major credit bureaus (Experian, Equifax, and TransUnion). On-time payments will help increase your credit score, but missed ones will drop it. You can set up auto payments to manage your loan without delays.

Achieve Compared to Other Lenders

Before you choose the right lender, consider all your choices. Let’s compare Achieve with other loan providers:

| Achieve | Happy Money | SoFi | OppLoans | |

|---|---|---|---|---|

| BadCredify’s rating | 4.7 | 4.7 | 4.8 | 4 |

| Minimum credit score | 620 | 640 | 680 | None |

| APR range | 8.99 – 29.99% | 8.95% – 17.48% | 8.99% – 29.49% | 160.00% – 195.00% |

| Loan Amounts | $5,000 – $50,000 | $5,000 – $40,000 | $5,000 – $100,000 | $500 – $4,000 |

| Repayment Schedules | 24 – 60 months | 24 – 60 months | 24 – 84 months | 9 – 18 months |

| Origination Fee | 1.99% – 6.99% | up to 5% | 1% – 6% | None |

| Funding Frames | 1 – 3 days | 3 – 6 days | 1 – 3 days | 24 hours |

| Bottom Line | Achieve, which used to be called FreedomPlus, gives personal loans that work well for combining a lot of credit card or other debt without collateral. This lender offers personal loans for people with average and good credit scores (from 630 to 719). Its typical borrowers have good credit and high income in their home. | Happy Money is big on credit card consolidation and helps borrowers understand their financial health. They offer things like personality evaluations and a no-cost update on your credit score every month. | SoFi loans can pay off bills like credit cards or help with adopting kids or IVF treatments, travel, and weddings. While there are no required fees, SoFi may offer the option to pay an origination fee of up to 6% of the loan amount in exchange for a lower interest rate. | Every major credit bureau receives a credit report of your payments from OppLoans. Thus, paying on time could boost your credit score. Conversely, missed payments may harm it. You’ll find some high-interest lenders report payments to one or two bureaus. |

Methodology

BadCredify uses a rating system with a maximum of 25 points that a company can get. These points are awarded based on the 5 key features (maximum 5 points for each parameter). Here are the evaluation categories we look at:

- Loan accessibility. We look at how easy it is to get a loan, especially for borrowers with bad credit.

- Interest rates and fees. Our experts are focused on how much the loan costs and whether the lender offers competitive APRs.

- Loan terms. We pre-qualify for loans and look at how transparent and reasonable loan terms are.

- Customer service. We contact the company’s customer support managers to assess the service it provides.

- Customer reviews. Our team of experts looks at what other clients say about their borrowing experience and evaluates the company’s reputation.

Based on these data, we calculate the total number of points and determine the final rating.

Frequently Asked Questions

What credit score do I need to get a loan from Achieve?

Achieve’s minimum credit score requirement is 620. If you’re going to borrow $35,000 or more, you will need a 660 credit score to qualify.

Does Achieve perform a hard credit check on the prequalification stage?

Achieve allows you to assess your potential loan terms by undergoing a soft credit check only. If you continue your application, a hard credit check will be performed. It may reduce your score by a few points and remain on your report for around two years.

How long does it take Achieve to approve a loan?

Achieve typically provides same-day approval for borrowers who complete application with all required supporting documentation and submit the loan request form early enough on a day that the company’s offices are open (Monday-Friday 6am-8pm MST, and Saturday-Sunday 7am-4pm MST). If approved, the money can reach your bank account in one to three days.